The Indian housing finance sector is booming, driven by urbanization, rising incomes, and government initiatives like Housing for All. Yet, many investors struggle to find reliable stocks in this space that offer growth potential without excessive risk.

Bajaj Housing Finance share stands out as a compelling option. As a subsidiary of Bajaj Finance, this company has shown rapid expansion and strong fundamentals since its high-profile IPO. This guide explores its current performance, investment merits, and what to expect moving forward.

Understanding Bajaj Housing Finance Limited

Bajaj Housing Finance Limited (BHFL) is a leading non-deposit-taking Housing Finance Company (HFC) in India. Registered with the National Housing Bank since 2015, it began mortgage lending in 2018.

As a 100% subsidiary of Bajaj Finance—one of India’s most diversified NBFCs—BHFL benefits from strong parent support and a trusted brand.

The company offers a wide range of mortgage products, including:

- Home loans for purchase or renovation

- Loans against property (LAP) for personal or business needs

- Lease rental discounting for developers and high-net-worth individuals

- Developer financing for residential and commercial projects

BHFL serves diverse customers, from salaried individuals to self-employed professionals, across prime, near-prime, and affordable segments. Headquartered in Pune, it operates over 200 branches nationwide.

It holds top credit ratings: AAA/Stable for long-term debt and A1+ for short-term programs from CRISIL and India Ratings.

Bajaj Housing Finance IPO and Listing Journey

BHFL’s IPO in September 2024 was one of India’s largest, raising over ₹6,500 crores at a price band of ₹66-₹70 per share.

The issue was heavily oversubscribed, reflecting strong investor interest in the Bajaj brand and housing sector growth.

On listing day, shares debuted with massive gains, reaching highs around ₹188. This premium reflected optimism about BHFL’s rapid AUM growth and low NPAs.

However, post-listing volatility set in, influenced by market corrections and promoter stake adjustments.

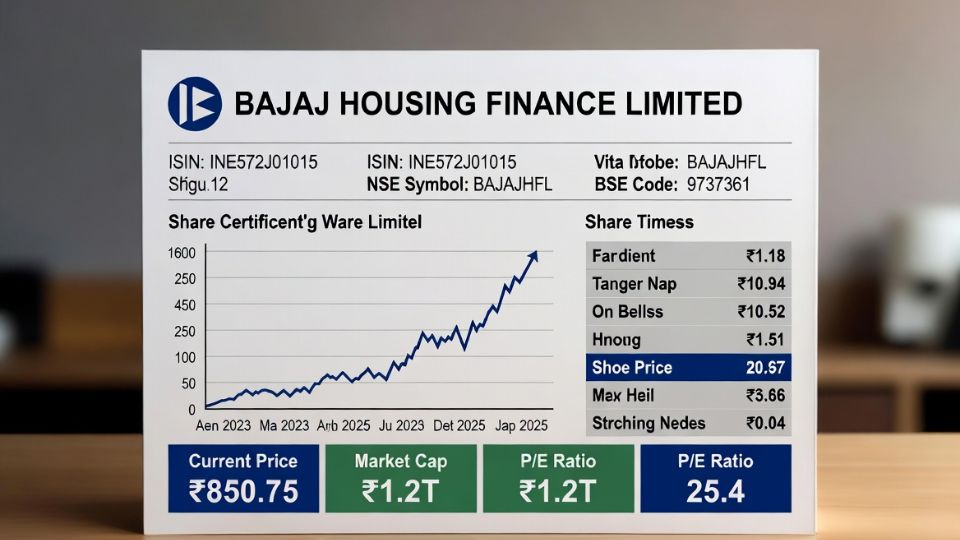

Current Bajaj Housing Finance Share Price and Performance in 2025

As of late December 2025, Bajaj Housing Finance share price hovers around ₹95-₹96, down significantly from its peak but above the 52-week low near ₹92.

The stock has corrected nearly 50% from highs, partly due to a block deal where Bajaj Finance sold about 2% stake to meet minimum public shareholding requirements.

This raised funds for the parent while increasing public float.

Despite the price dip, fundamentals remain solid:

- AUM surpassed ₹1 lakh crore

- Consistent profit growth

- Low gross NPAs

Year-to-date in 2025, the stock has underperformed broader indices amid sector pressures like interest rate fluctuations.

Many analysts view the current levels as an attractive entry point for long-term investors.

Financial Performance Highlights

BHFL has delivered impressive growth:

- Revenue on a trailing 12-month basis exceeds ₹10,000 crores

- Profits around ₹2,300-₹2,400 crores annually

- Strong return ratios and controlled costs

In recent quarters, net interest margins stayed healthy despite rising funding costs.

The company’s centralized underwriting and tech-driven processes help maintain asset quality—one of the best in the industry.

BHFL aims for 5% market share in home loan acquisitions over the medium term, up from under 2.5% currently.

Comparison Table: Bajaj Housing Finance vs Key Competitors

| Metric (as of latest available data) | Bajaj Housing Finance | LIC Housing Finance | PNB Housing Finance | Aptus Value Housing |

|---|---|---|---|---|

| Market Cap (₹ Cr) | ~79,000-80,000 | ~35,000 | ~15,000 | ~10,000 |

| AUM (₹ Cr) | >1,00,000 | ~2,80,000 | ~65,000 | ~9,000 |

| P/E Ratio | ~33-37 | ~8-10 | ~10-12 | ~25-30 |

| Gross NPA (%) | <1% | ~3-4% | ~1-2% | <1% |

| ROE (%) | ~10-11% | ~12-14% | ~10% | ~15% |

| Growth Focus | Retail mortgages, tech-enabled | Large portfolio, affordable housing | Revival phase | Affordable segment |

BHFL trades at a premium valuation due to superior growth and asset quality, but offers better scalability than smaller peers.

Pros and Cons of Investing in Bajaj Housing Finance Share

Pros

- Strong Parentage: Backed by Bajaj Finance, providing access to a vast customer base and expertise.

- Rapid Growth: One of the fastest-growing HFCs, with high disbursement rates and branch efficiency.

- Excellent Asset Quality: Among the lowest NPAs in the sector, thanks to prudent underwriting.

- Diversified Portfolio: Balanced mix of home loans, LAP, and developer finance reduces risk.

- High Credit Ratings: Enables low-cost borrowing and investor confidence.

Cons

- Valuation Premium: Higher P/E and P/B ratios compared to peers may limit short-term upside.

- Interest Rate Sensitivity: Rising rates could pressure margins and demand.

- Regional Concentration: Significant AUM from a few states poses geographic risk.

- Promoter Stake Dilution: Ongoing sales to meet MPS requirements may create short-term overhang.

- Market Volatility: Housing finance stocks can be cyclical, affected by real estate trends.

Overall, the pros outweigh cons for patient investors focused on long-term housing demand in India.

Factors Influencing Bajaj Housing Finance Share Price

Several elements drive the stock:

- Macro Environment — RBI policies, repo rates, and economic growth impact borrowing and repayments.

- Company Results — Quarterly AUM growth, profit margins, and NPA levels are key triggers.

- Sector Trends — Government push for affordable housing and urbanization support demand.

- Analyst Views — Consensus targets around ₹110-₹140 suggest moderate upside from current levels.

- Technical Factors — Support near ₹92; resistance around ₹100-₹110.

Monitoring these helps time investments better.

Conclusion

Bajaj Housing Finance share offers a blend of growth, quality, and brand strength in a promising sector.

While 2025 has seen corrections due to external factors, the company’s fundamentals—robust AUM expansion, low risks, and strategic focus—position it well for recovery and long-term gains.

India’s housing finance market is poised for multi-year growth, and BHFL is a prime beneficiary.

If you’re building a diversified portfolio, this stock deserves consideration, especially at current valuations. Always assess your risk tolerance and consult a financial advisor.

FAQ

1. What is the current Bajaj Housing Finance share price?

As of December 23, 2025, the share price is approximately ₹96. Prices fluctuate daily, so check live quotes on NSE/BSE for the latest.

2. Is Bajaj Housing Finance a good investment in 2025?

It can be suitable for long-term investors due to strong growth prospects and asset quality. However, high valuations and rate risks warrant caution. Many analysts rate it as a Hold with potential upside.

3. What are the analyst price targets for Bajaj Housing Finance share?

Average 12-month targets from analysts range around ₹110-₹120, with highs up to ₹140. This implies 15-25% potential upside from current levels, though views vary.

(Word count: approximately 1,550)